ERP in Manufacturing: How MRP Turns Production Chaos Into Predictable Delivery

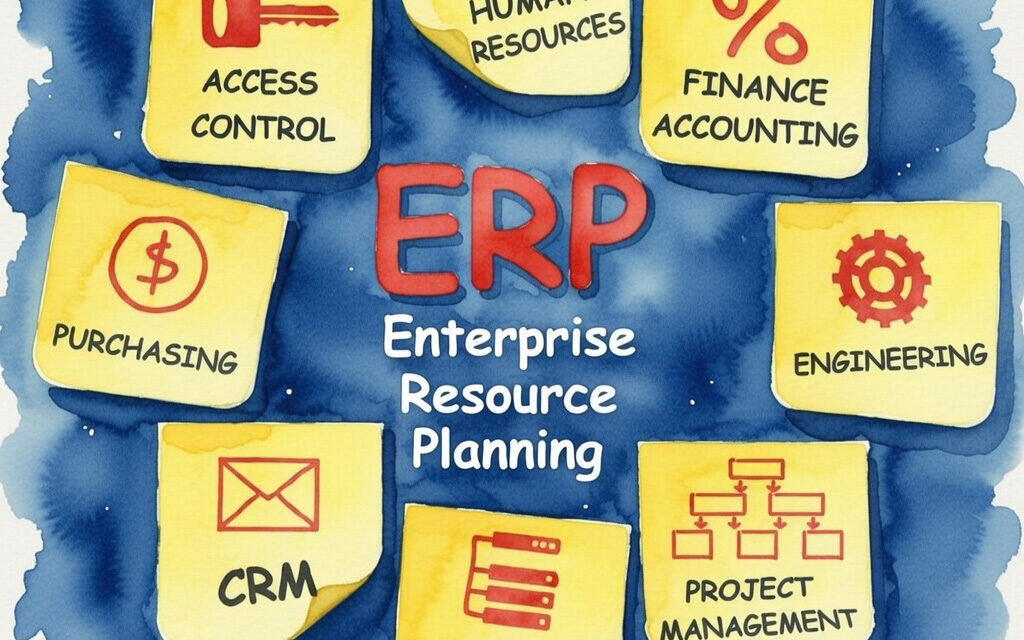

Manufacturers win or lose on one question: Can you produce the right items, in the right quantities, at the right time—without tying up cash in unnecessary inventory? When spreadsheets, disconnected systems, and informal processes drive planning, businesses drift into late deliveries, frequent shortages, production downtime, and margin leakage. This article explains how ERP-enabled MRP (Material...