Over the past three decades, global equity markets have witnessed dramatic cycles of boom, bust, and recovery. From the euphoria of the dot-com era to the scars of the global financial crisis and the uncharted turbulence of the COVID-19 pandemic, equity performance has painted a vivid narrative of economic transformation across regions.

Over the past three decades, global equity markets have witnessed dramatic cycles of boom, bust, and recovery. From the euphoria of the dot-com era to the scars of the global financial crisis and the uncharted turbulence of the COVID-19 pandemic, equity performance has painted a vivid narrative of economic transformation across regions.

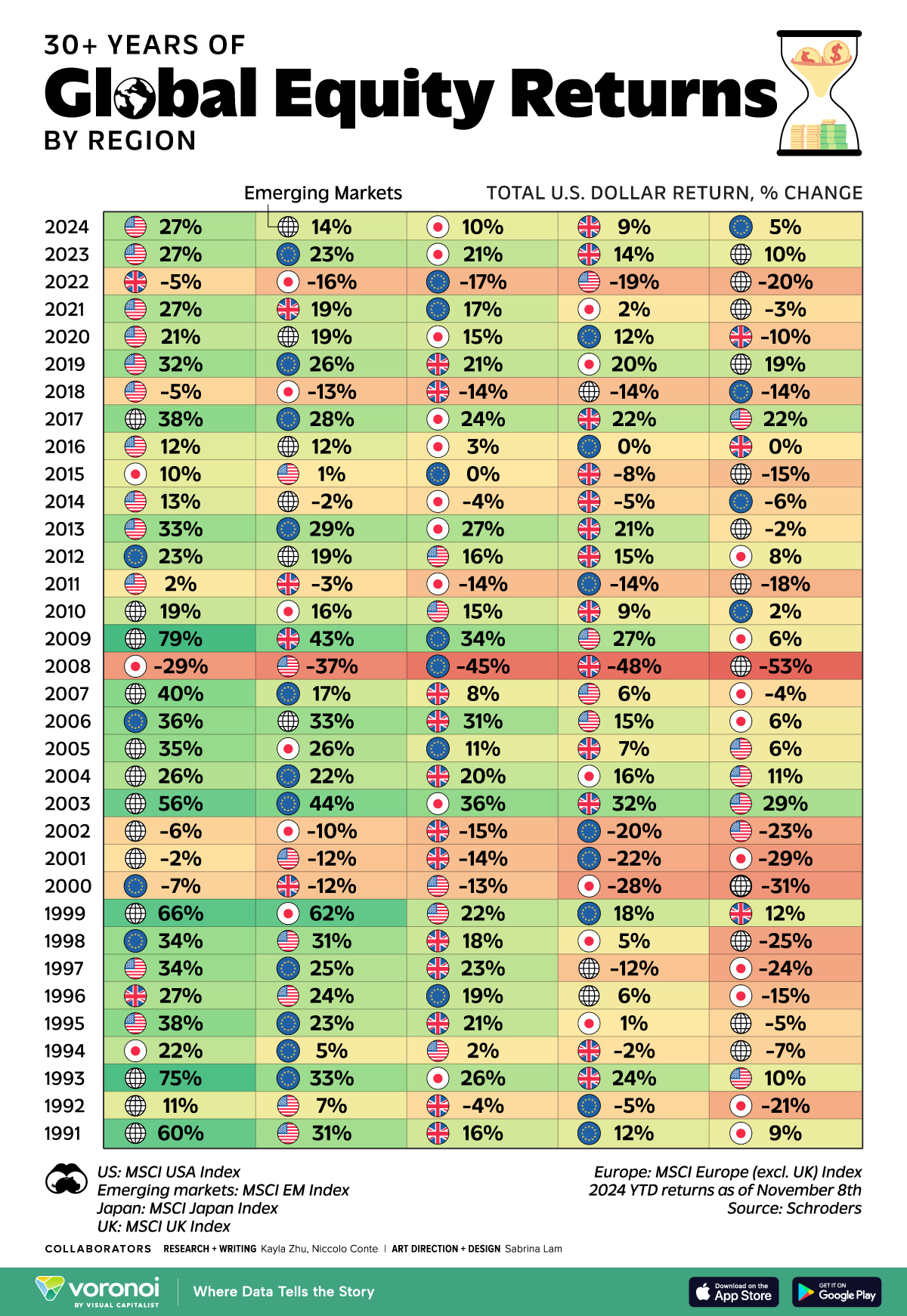

Using MSCI indexes for the U.S., U.K., Europe (excluding the U.K.), Japan, and Emerging Markets, the chart sourced from Schroders captures annual total U.S. dollar returns since 1991—offering not only historical insight but also strategic foresight for investors, institutions, and policymakers alike.

🗽 U.S. Equities: A Longstanding Global Powerhouse

The United States equity market has emerged as the dominant global player, particularly in recent years. Since 2010, it has consistently outperformed other regions, claiming the top spot for 10 of the past 15 years, including the year-to-date performance in 2024 at a remarkable 27%.

This ascendancy has been driven by robust corporate earnings, global tech leadership, and monetary policies favoring asset inflation. Even during the pandemic, U.S. equities quickly rebounded, bolstered by innovation-led sectors and resilient consumer demand.

However, the U.S. wasn’t always the leader. Between 2002 and 2005, it ranked as the worst-performing region, reflecting the aftermath of the dot-com bust and the ensuing corporate governance reforms. In 2002, it posted its worst annual return in this dataset: -23%.

🌍 Emerging Markets: From Rising Stars to Relative Laggards

In the 1990s and early 2000s, emerging markets shone brightly. Driven by liberalization, globalization, and high-growth economies like China, India, Brazil, and South Korea, this group outperformed all others in 12 out of the 20 years from 1991 to 2010. For instance, in 1999, emerging markets soared with a staggering 66% return, buoyed by optimism in Asia and Latin America.

The decade between 2001 and 2010 saw an annualized return of 15.9%, according to AllianceBernstein, significantly outpacing developed market counterparts. Yet, since 2011, the shine has faded, with annualized returns dropping to just 0.9%—reflecting geopolitical headwinds, volatile currencies, and structural growth challenges.

In 2024, they are making a modest comeback with 14% YTD returns, indicating potential for renewed investor confidence.

🇪🇺 Europe (ex-UK): Stability with Subdued Spark

European equities, while less volatile than emerging markets, have underperformed their U.S. counterparts in recent years. That said, they have offered comparatively stable returns, avoiding the deep drawdowns of other regions.

In 2024, Europe is rebounding, registering a 5% return—driven by softening energy prices, post-COVID consumer resilience, and cautious central bank strategies. Its best years, such as 2006 (36%) and 2003 (44%), reveal its latent strength during recovery periods. Yet, the region has seldom led the global equity leaderboard, emphasizing its role as a stabilizer rather than a star.

🇬🇧 U.K. Equities: A Mixed Bag

The U.K.’s equity performance has been marked by periods of resilience interspersed with stagnation. It led global returns in 2022 with -5%, highlighting a relatively less severe downturn amid a broad global correction.

However, Brexit-related uncertainties and a narrower base of high-growth companies have often capped upside potential. In years like 1996 (27%) and 2009 (43%), U.K. equities impressed. Yet, in many others, they lagged behind broader trends.

In 2024, the U.K. is holding firm at 9% YTD, reflecting selective sectoral strength and valuations catching up post-pandemic.

🇯🇵 Japan: From Giant to Gentle Growth

Japan, once the dominant market in the late 1980s, has faced prolonged stagnation. It has rarely topped the return charts, although occasional rebounds—like 2015 (10%) and 2003 (36%)—show the potential of cyclical comebacks.

Demographic challenges, deflationary pressures, and a slow tech transition have weighed on its performance. In 2024, Japan has delivered a 10% YTD return, signaling improved investor sentiment amid structural reforms and a weaker yen supporting exports.

🌐 Lessons from the Past, Vision for the Future

The historical trends reveal a clear cyclical nature in global equity performance. Regions rise and fall not in isolation but in response to macroeconomic forces, innovation waves, political shifts, and capital flows.

Key takeaways include:

-

Diversification matters: No single region leads consistently. Portfolios should balance exposure across geographies.

-

Crisis brings opportunity: Markets tend to recover sharply after major downturns—such as in 2009, when emerging markets gained 79% post-GFC.

-

Leadership shifts: While the U.S. has dominated recently, emerging markets and Europe may hold latent opportunities amid changing global dynamics.

📊 Dawgen Global’s Perspective

At Dawgen Global, we believe that navigating the complexity of global capital markets demands more than just historical reflection—it requires strategic foresight, real-time intelligence, and customized financial architecture designed to thrive amid uncertainty.

🌍 Multi-Disciplinary Expertise for a Global Landscape

Our Team of Analysts and Economic Advisors operates at the intersection of data-driven intelligence and human insight, helping clients decode macroeconomic signals, geopolitical trends, and market cycles across regions. With dedicated professionals in the fields of economics, finance, accounting, investment strategy, and regulatory policy, we provide a 360-degree advisory platform that is both proactive and agile.

📈 Investment and Economic Insights Tailored to You

We don’t believe in one-size-fits-all advice. Instead, we deliver bespoke investment insights that consider your organization’s risk tolerance, growth horizon, liquidity requirements, and sector exposure. Whether you’re a multinational corporation, a family office, or an SME seeking to optimize returns, our analysts develop custom models and scenarios that project how global equity shifts—from U.S. tech growth to emerging market volatility—will impact your financial objectives.

🔍 Macroeconomic Trend Analysis

Our macroeconomic advisory goes beyond headlines. We produce in-depth reports and strategic outlooks that assess inflation dynamics, monetary policy shifts (e.g., Fed rates or ECB tapering), currency fluctuations, commodity price cycles, and regional political risks. This empowers clients to anticipate disruptions and capitalize on emerging themes—whether it’s the rebound of European equities or a resurgence in Southeast Asian markets.

⚖️ Risk-Adjusted Portfolio Strategies

A critical pillar of our support is designing risk-adjusted portfolio strategies. We use quantitative tools to measure beta, volatility, Sharpe ratios, drawdowns, and stress-test portfolios under varying conditions. We then propose rebalancing solutions, diversification structures, and hedging instruments that align with both client goals and evolving global realities.

🤝 Client-Centric Engagement

Through continuous engagement and transparent communication, our advisors act as trusted partners—not just service providers. We host quarterly economic briefings, investment outlook sessions, and provide real-time updates on material market changes, ensuring clients are not only informed but also empowered to make timely decisions.

🎯 Our Mission

At Dawgen Global, our mission is to transform financial data into strategic intelligence—giving our clients a decisive edge in capital deployment, market timing, and long-term wealth creation. Whether your journey involves local market penetration or global diversification, we provide the clarity and confidence to move forward.

Next Step!

“Embrace BIG FIRM capabilities without the big firm price at Dawgen Global, your committed partner in carving a pathway to continual progress in the vibrant Caribbean region. Our integrated, multidisciplinary approach is finely tuned to address the unique intricacies and lucrative prospects that the region has to offer. Offering a rich array of services, including audit, accounting, tax, IT, HR, risk management, and more, we facilitate smarter and more effective decisions that set the stage for unprecedented triumphs. Let’s collaborate and craft a future where every decision is a steppingstone to greater success. Reach out to explore a partnership that promises not just growth but a future beaming with opportunities and achievements.

✉️ Email: [email protected] 🌐 Visit: Dawgen Global Website

📞 Caribbean Office: +1876-6655926 / 876-9293670/876-9265210 📲 WhatsApp Global: +1 876 5544445

📞 USA Office: 855-354-2447

Join hands with Dawgen Global. Together, let’s venture into a future brimming with opportunities and achievements