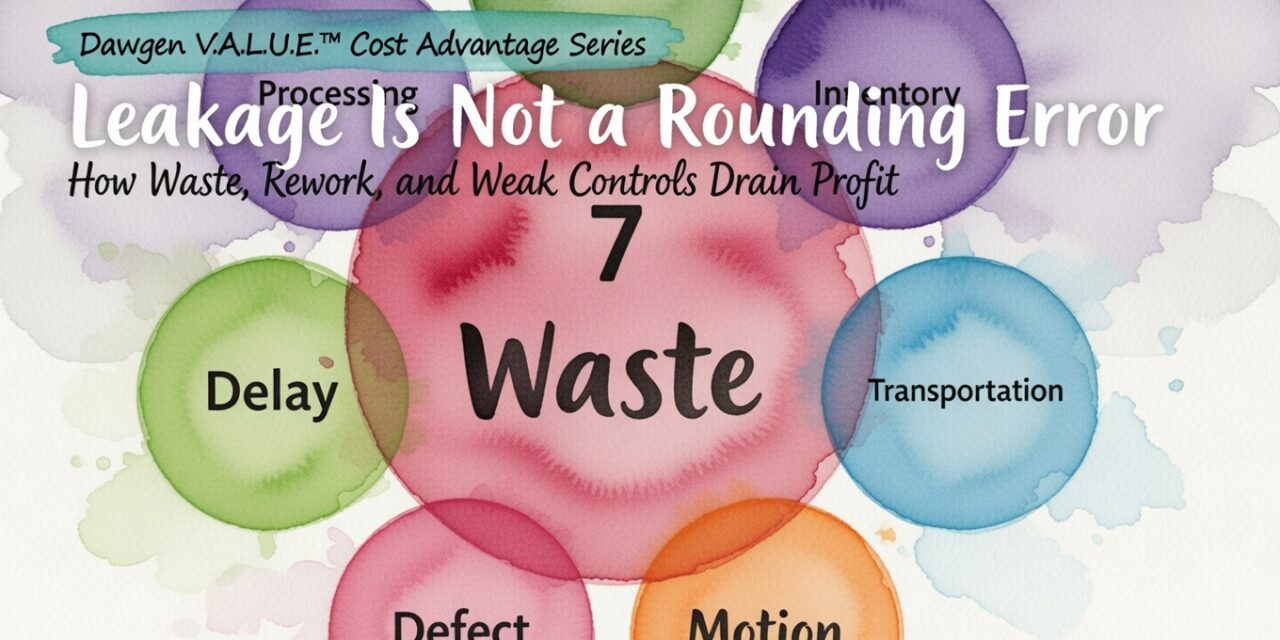

Leakage Is Not a Rounding Error: How Waste, Rework, and Poor Controls Drain Profit—and What to Do About It

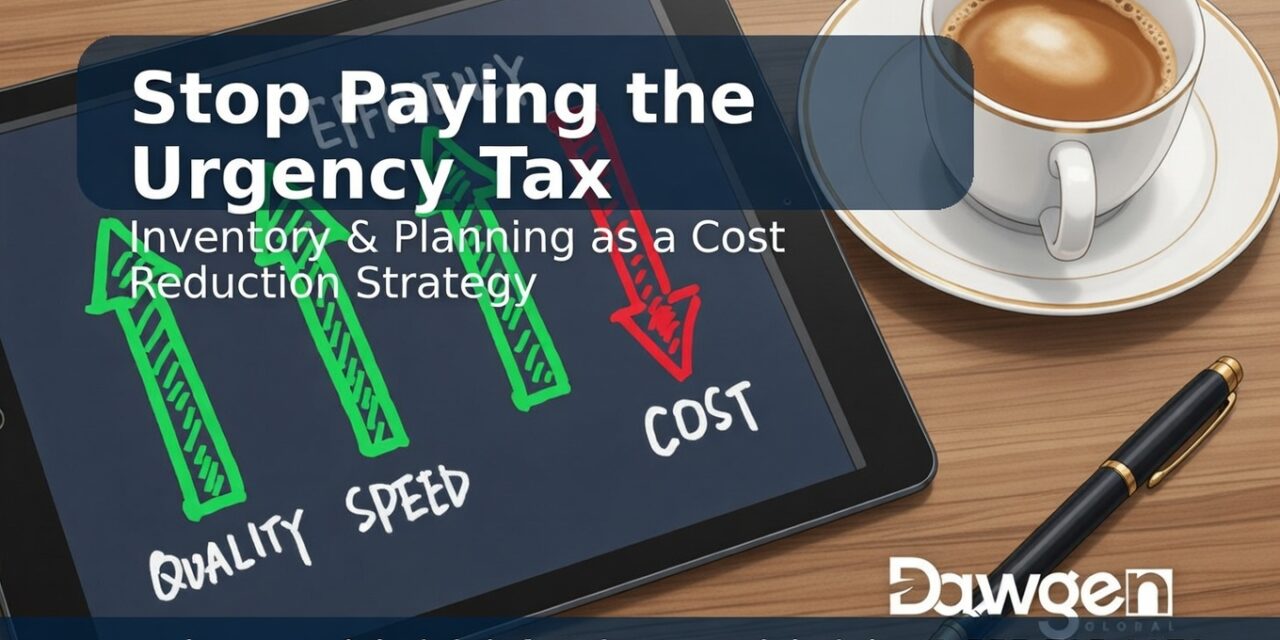

Executive Summary Most organisations think profitability is lost in big-ticket decisions—pricing, headcount, or major contracts. In reality, margins often die quietly through leakage: small, repeated losses caused by waste, rework, errors, weak controls, and ungoverned exceptions. Leakage compounds. It creates hidden “cost gravity” that drags down profit even when revenue is stable. In the Caribbean,...